The logistics sector cannot be digitalized — they said

The logistics field is massive. Simply said, whenever anything is sold or bought sooner or later, transport is involved. Online stores, retail stores, manufactures, coffee shops, restaurants, small boutiques, large factories, flower shops… you-name-it — at some point, they all need transport services. Even banks (purely digital world, right?) ship documents back and forth every day. It’s massive.

But strangely enough logistics field is far from innovative. In fact, some say diesel truck is the most technically advanced piece of equipment there is. This, of course, is an exaggerated statement as most of the global transport companies have fancy customer portals, API connections, complex terminal and loading systems, etc. Still, overall the field is very slowly progressing.

Another aspect is that this field is highly fragmented. The chances are that in your area, there are hundreds if not thousands of small logistics companies. Sounds crazy? We have more than 500 validated active transport companies registered in our platform for the Estonian region only, and we are not even getting close to limits yet.

So why is that? Why do large global giants not wipe out all the small players? Because small players are much more flexible. Often, they are operating in a particular corner or offering very specific service, and they are doing it very well. This leads to a situation where the typical mid-size company uses 5 to 20 different logistics providers. Typically, large quantities are shipped with one partner; for small parcels, there is another partner. To Nordic countries, it is better to send goods with a third partner. Then there are 40’ sea containers from Asia, fast express shipments to the other side of the world, fragile goods, occasionally dangerous shipments, small local parcels to parcel machines, and so forth.

It is often a question of balance. Either you choose one logistics partner and simple communication but will not have the flexibility and coverage. Or you choose the best partner for each scenario but will also have a heavy handling layer on top of it.

One way or the other, it adds up high additional costs, but more importantly, it leads to inefficient logistics management.

But the challenges differ for companies of different sizes. The problem for smaller companies often is how to select the right partner? Or even where to find one? Even if you can find them who to contact in different cases?

Mid-size companies normally have a pretty good idea who to work with. The question comes down to how to keep the daily operational activities clear and simple.

Large companies often struggle with system integrations between their own system and their logistics company. It is fairly easy to build one connection. But how about 10 different connections? And then next year partners will change. Or something changes in the API connection? Or is the connection not as reliable as it was advertised? Or new project needs a new connection by tomorrow?

3PL vs 4PL

In the logistics field, it has been a long debate either 3rd Party Logistics or 4th Party Logistics is the right way to go.

Quick recap. 3PL model assumes the company is still in charge of its logistics setup but outsources transport and logistics tasks to a third party who may outsource these tasks further. In other words, the company will still have a logistics department or person who is responsible for negotiations with transport companies, places transport bookings, handles all transport-related questions, but the main transport partner can cover a large part of the company’s needs.

4PL model assumes the company outsources its entire logistics setup. The assumption here is that this way company can focus on its main activity and trust the entire supply chain management to an external partner. In another words company hands over its logistics department to 4PL partner.

Often 4PL is somewhat praised. The idea of 4PL model has been around for quite some time, but in reality, there are not so many companies who have chosen this path. The main reason there seems to be that companies do not want to give away control over their supply chain. After all, they know their product is the best, and keeping this know-how in-house seems to be the preferred way.

IT service provider or Logistics broker

The idea of one window to gather all carriers is not new. But it is important to understand the business model behind this window. Is it Logistics Dashboard that allows digitalizing logistics processes, or is it Digital Logistics Broker promoting specific logistics services?

For such a platform, at first glance, it seems like a good idea to charge a percentage per transaction amount. This approach seems to be fair to all parties — you pay per usage and volume. Companies that have many shipments pay more, others pay less. Small parcels cost less, large full containers cost more.

But the downside is that not all logistics companies are willing to play ball on those terms. Most of them have very strict terms of their own. Naturally, you are tempted to favor some logistics provider over another. And once this happens in the eyes of your customer, you have lost the image of an independent IT service provider, and you have become just another expeditor.

Digitalizing Logistics

Now that we have covered the most important aspects of this topic, we are ready to address the initial challenge. How to digitize logistics processes? Even though all global logistics companies do have their own customer portals where customers can log in and place transport orders, they still need to do it manually. Yes, if you have many shipments, you can integrate your system into the carrier portal. But how about 5 different carriers, how about 20? What if you need to change your logistics partner next year? And what about those local small carriers who accept transport orders only via email?

One solution to this challenge is www.cargoson.com

There are 2 steps to set up your Cargoson account.

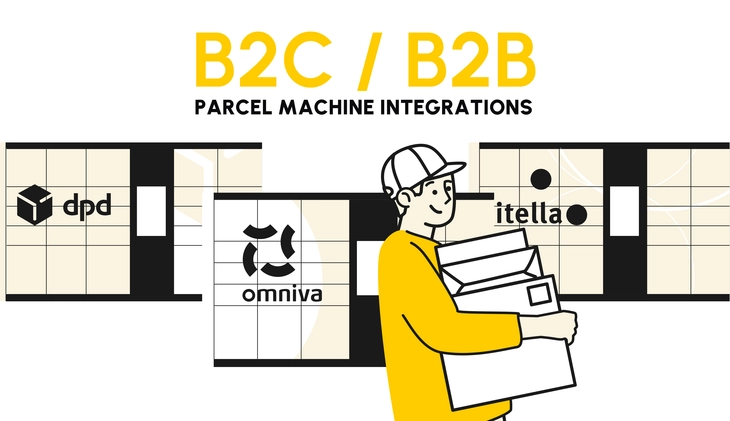

Firstly, you need to select which cargo carriers you would like to work with. Often those partners are already known, and cooperation is well established. But every now and then, interesting new opportunities arise, and your list of carriers can be updated at any time.

Secondly, you have to describe and set up your business agreements with your carriers. Typically, these are pricelists, price requests, contact persons, agreed directions, lead times, etc.

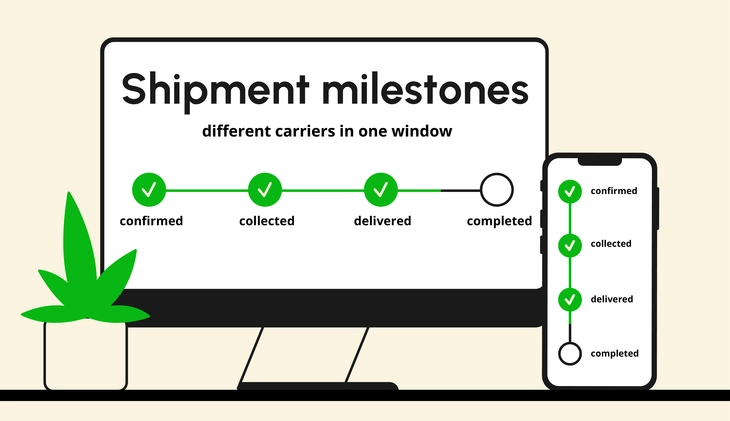

Once the account is set up, you need to enter your shipment parameters (from where, to where, goods quantities), and Cargoson will look up different shipping possibilities for you. You can check estimated transport costs, book shipments, print labels, track your goods, or notify your customers — all from one place.

All good but there is still quite a bit of manual work, you might say. True.

The third step is optional — you can integrate Cargoson into your ERP system. This way, anyone from your company can trigger transport orders or check estimated transport costs directly from your own business system.

In Cargoson, the integration to all major logistics companies is already prebuilt. You just need to add your own account code or API key to Cargoson, and the connection is activated.

You can also add your local small carriers to your list. You can upload your agreements, and the estimated transport cost is calculated the same way as it would be for global logistics companies. If those small companies do not have their own system ready yet, all transport orders are sent to them via email.

Next steps

Since the very beginning, Cargoson has been a worldwide project. We see Estonia as our test market, Europe as home turf, and the rest of the world as a bucket of fascinating challenges.

We onboarded our first customers in 2019. Even though those were real customers and real shipments, we still consider them as pre-release test-users. We started active sales activities early in 2020. In Q1 2020, we had 1644 shipments going through our system. A year later, in Q1 2021, we had 31 878 shipments going through our system. The progress was deliberately held back. We had only one goal in mind — to get our user experience as close to the real world as possible. We spent endless hours next to our customers speaking, watching, asking questions, and learning their ways of handling their logistics. It took 1.5 years before we felt confident enough to implement self-onboarding for small customers and hand the process over to auto-pilot.

It was mid-2020 when we also started exploring new markets in Latvia and Lithuania. Once again not aiming for quick numbers, rather understanding how the market differs from what we have seen so far. New carriers were integrated, lessons were learned, adjustments were made — now we feel ready to boost the sales activities and scale further. Not only was this an exciting period, but it also validated our model to be scalable. Needed adjustments were not so much destination market-specific, rather necessary for further scaling. And it does look very promising.