This article offers insight into ESG reporting. You will learn why has it been introduced and if it is optional or mandatory for your company. I will also write about why your company could benefit from voluntary reporting and how Cargoson can help you with the environmental aspect of ESG reporting.

Environmental, social and governance – what’s in it?

Environment

Commitment to sustainability and responsible environmental practices

- Energy efficiency

- Greenhouse gas emissions,

- Pollution, waste management

- Resource conservation

Social

Commitment to social responsibility and ethical practices:

- Labor standards

- Employee diversity and inclusion

- Community impact

- Customer relations

Governance

Structure and practices of a company's leadership and management.

- Board diversity

- Executive compensation

- Risk management

- Transparency

Why do we need ESG reporting?

Companies have been able report on their ESG efforts for a long time independently from regulators like the EU parliament, but until now it has not been possible to reliably assess a company’s efforts nor sum up the numbers to make wide-scale conclusions and decisions.

ESG as a term was first mentioned in U.N. 2004 joint report with 50 financial institutions – Who Cares Wins, but according to Google trends ESG only started to gain traction in 2018 as a search phrase and from there, its usage has whoppingly sixfold by the time of writing this article in February 2023.

So, one can only imagine the interest in ESG from companies' marketing departments, which raises the question about the reliability of the data presented by the companies.

To address these issues, The European Parliament has set the rules in The Corporate Sustainability Reporting Directive (CSRD) which entered force on 5 January 2023.

Concerned companies will have to apply the rules for the in the financial year 2024, for reports published in 2025 (European Commission).

CSR directive states that the information companies provide on their report must be independently audited and certified. This guarantees that financial and sustainability reporting will walk hand in hand which makes data reliable, transparent and comparable.

Who cares about your ESG efforts?

There are multiple macro-level reasons why improving environmental, social and governance aspects in your company is important but this is not the focus of this article. I rather try to bring out potential stakeholders for your company.

Millennials, born between 1981-1996, constitute a big part of potential customers and employees in our current economy. Their purchase decisions are more and more influenced by how green and ethical has been the process to manufacture the product of their interest and look to work for companies with sustainable road-map.

These companies in turn are forcing their suppliers down the line to become more transparent about their operating methods, mainly on an environmental and social level.

Independently of the size of the company customers, suppliers and investors are increasingly interested in their partner's ESG efforts. Therefore being transparent and providing this information gives companies an advantage in front of those that don’t value it just yet.

For reporting structure and steps you will receive all necessary support from your auditing company – the most common suspects of which are KPMG, EY, Deloitte and PWC, but there will be many more players on the market as auditing in Europe is on the route to be standardized.

Is ESG reporting obligatory for my company?

EU sustainability reporting is obligatory if the company fills at least one of the following conditions:

- 250 employees during a financial year

- net turnover of 40 million EUR

- Listed small and medium-sized enterprises (SME)

If your company meets or exceeds one of those numbers then you have an obligation.

Even if your company does not exceed any of these milestones, but wants to be competitive in a long term then there is a good chance that voluntary reporting could benefit your company, too.

How Can Cargoson help?

If your company sends or receives goods from customers and suppliers, then there is a high chance that Cargoson can help you with reducing your company’s carbon footprint. According to the UN, 23% of man-made emissions are generated by transport, which makes it a significant piece in the ESG puzzle.

When companies start focusing on reducing carbon emissions, they commonly think about carbon offsetting (also referred to as greenwashing). It allows companies to keep producing emissions and later compensate for it through the increase of carbon storage – planting trees for example. While it helps, it is still dealing with the consequence after the harm has been done.

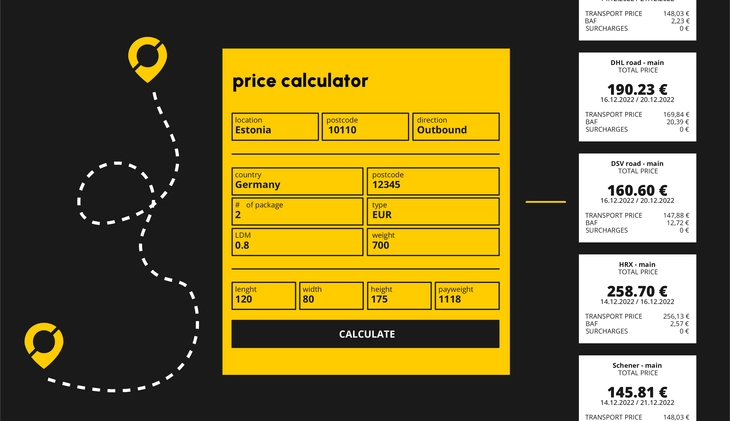

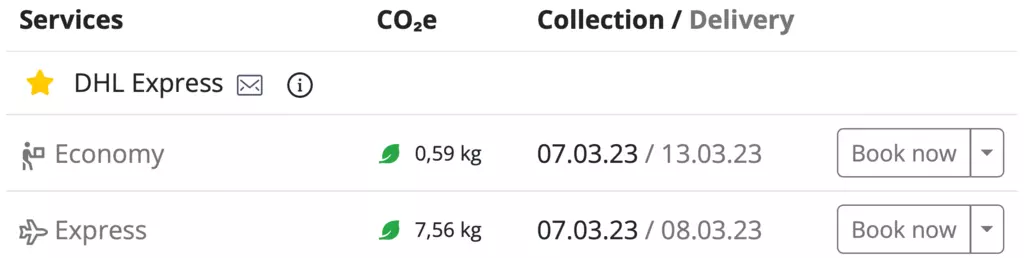

Cargoson calculates CO2 estimates for every shipment, carrier and transport type before the shipment has been booked. This allows companies to react proactively and avoid excess CO2e production on first hand, by choosing less polluting transport types or a carrier with newer trucks.

For example, sending a 1 kg package from France to Sweden by air is faster, but consumes close to 4 times more CO2 emissions – if you are not in hurry, then you might want to opt for transporting this package by land (see figure above).

Making environmentally friendly transport decisions in Cargoson is easy and therefore it is a fast, effortless and cost-efficient way for companies to start reducing their carbon footprint to set a positive trend in their ESG metrics.